06 September 2016

By Maynard Paton

Quick update on Tasty (TAST).

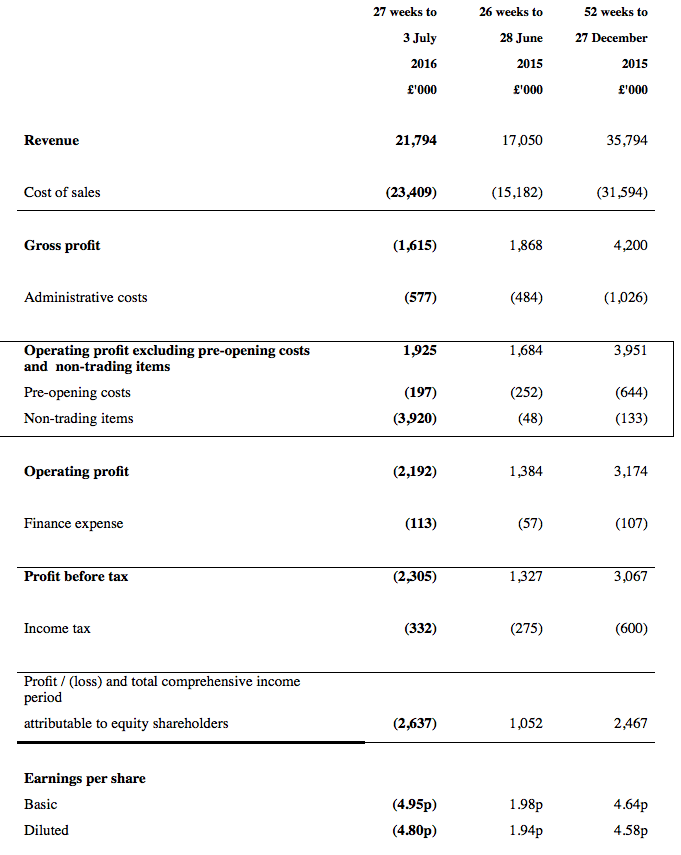

Event: Interim results for the 27 weeks to 03 July 2016 published 06 September 2016

Summary: These results were very mixed. I am pleased the restaurant chain’s revenue growth has improved following the ‘blip’ in the second half of last year, but disappointed the roll-out plan has slowed a little. Margins have also shrunk due to greater expansion costs. Mind you, the board here remains a class act while the longer-term potential is still considerable. I sold some shares before these results and I continue to hold the rest.

Price: 170p

Shares in issue: 53,360,324

Market capitalisation: £90.7m

Click here for all my previous TAST posts

Results:

My thoughts:

* I must admit to having felt uneasy ahead of these results

You may recall that TAST’s 2015 annual results had previously caused me a few worries.

In particular, I deduced slower sales growth was recorded during the second half, and noted management remarks about additional costs to handle the group’s expansion.

In addition, I had tracked the number of new restaurant openings this year — 7 so far — and thought that was somewhat low given the chain’s stated target of 15.

All in all, I felt a little uneasy during the summer, worrying that perhaps the slower roll-out was signalling the H2 sales issue had not been resolved — and yet costs were rising.

Given TAST also sported a rich share-price rating and represented my largest portfolio holding, I decided to trim my position ahead of this H1 statement. I sold 11% of my holding at 184p after all costs.

In the event, these results provided some encouragement on the sales front. However, the additional expansion charges have now come through and I am a tad disappointed about the roll-out schedule.

* Encouraging revenue news after last year’s H2

These results showcased revenue up 28% to £21.8m.

The top-line performance was supported by four new restaurants (taking the estate to 52 at the half-year) and an extra trading week.

I calculate annualised revenue per outlet ran at £856k during this first half, which compares favourably to the disappointing £833k produced during H2 last year.

However, the £856k produced this time was below the £874k revenue per unit run-rate witnessed during H1 2015. So I guess there is scope for further improvement.

Mind you, revenue per restaurant may well decline over time as extra sites are opened outside of London.

Furthermore, TAST admitted within today’s statement that five of its restaurants had not performed to expectations (and had created a £3,576k write-off).

So perhaps the lower revenue per site versus last year’s H1 was due to these five particular outlets, rather than a general slowdown across the group.

(I note that TAST has kept the five under-performing sites open).

Anyway, at the AGM in May, TAST’s management claimed the chain had suffered a “slight blip” with last year’s H2 trading. Overall I am glad there has now been an improvement and the “slight blip” has not become something more sinister.

* Restaurant openings may not reach the 15 target

I am a tad disappointed with TAST’s opening schedule for new restaurants.

March’s annual results had signalled 15 new sites would be opened during 2016 — but only seven have started trading, with a further three under construction and at least a further four to start construction after this month.

So it looks as if it is touch and go as to whether the firm will hit its target of 15 openings.

It’s not clear to me why just four new sites were opened in the half.

Perhaps a temporary hold was placed on signing new leases because the chain wanted to resolve the trading ‘blip’ from the previous H2. Or maybe the group’s new property director simply wanted to re-jig the expansion plan.

(I should add that the new property director used to work for Prezzo (PRZ), where he oversaw 30 restaurant openings a year)

At least these results confirmed TAST wants to open a further 15 sites during 2017.

I must be honest, I had hoped for more than 15 for 2017 after talk at the AGM mentioned the firm aiming for “20 a year” at some point.

* Greater costs now appearing and hindering margins

TAST’s 2015 results hinted strongly at greater costs to assist the group’s expansion, and these results confirmed the additional investment:

“The Group has successfully implemented its programme of operational improvements during the period which has included changes to the central kitchen infrastructure and upgrades to a number of key systems.

Appointments have been made across the Group in: Operations, Marketing, Finance and HR departments to support future openings and the Group’s expansion. The Group websites and the wider digital marketing strategy continue to be developed as planned.”

The cost of the improvements caused the H1 gross margin to drop from 11.0% to 10.3% and the H1 operating margin to fall from 8.1% to 7.7% (or from 9.6% to 8.6% before pre-opening costs).

The decline correlated with management comments at the AGM, which said margins for 2016 would be “slightly down”.

I’d like to think the majority of TAST’s improvement costs are now in place and that margins for 2017 and beyond can at least be sustained as revenue continues to advance.

* Further debt funding looks likely

The half year witnessed the firm’s net debt position expand from £3.5m to £7.4m as a further £5.0m was spent on new restaurants.

Just before the half-year end, the group was granted an enlarged banking facility — from £8m to £12m.

TAST still has £2m to draw down from that facility, and with £2.6m of cash in the bank, plus annual operating cash flow of, say, £6m, the business could in theory spend almost £11m on new sites this year.

However, I don’t believe £11m is enough to fund the target 15 new restaurants when the last 18 months have seen almost £15m spent on opening 16 new sites.

For what it’s worth, management talk at the AGM disclosed the group needed about 100 restaurants to become self-funding — and that new funds could be raised either by extra debt and/or a share placing.

At least the cost of TAST’s loans do not appear onerous. The interest charge for the last six months came to £113k on average debt of £7.9m — I make that to be annualised interest at just 3%.

Valuation

* I continue to believe TAST can become ‘the next PRZ’

I have always felt that TAST could become a lucrative investment for long-time shareholders.

The boardroom comprises two members of the Kaye family, who have already built and sold multi-bagger chains ASK Central for £223m (in 2004) and PRZ for £304m (in 2015). I remain hopeful the Kayes can complete the hat-trick with TAST.

To put the upside possibilities into perspective, PRZ was acquired early last year for £304m when it operated with 245 restaurants, and that is the scale I hope TAST can one day reach (TAST is currently valued at £91m and operates with 55 restaurants).

That said, notable differences are now emerging between TAST’s current progress and PRZ’s growth record.

For example, PRZ never took on debt and bought some freeholds, while TAST has taken on debt and its estate is entirely leasehold.

If I adjust for PRZ’s freeholds, that ‘target’ market cap is reduced from £304m to £274m. And if I consider TAST’s debt, I really ought to be using the group’s current enterprise value of £98m to judge the possible upside.

So… whereas I could project TAST going from £91m to £304m and a possible 234% gain, a more conservative view perhaps is going from £98m to £274m and a potential 180% return. Accounting for TAST’s outstanding options would then reduce that 180% return further.

Another notable difference beginning to emerge between PRZ and TAST concerns margins.

Back in 2005 when PRZ’s estate expanded from 48 to 72 sites, its operating margin was 15%.

In contrast, TAST’s margin appears unlikely to top 10% this year with between 50 and 60 sites. I just wonder if that lower margin may in time reflect a lower potential future value for TAST.

All that said, I must remember it has never really paid to bet against the Kaye family — even though TAST’s present roll-out may be a little slower than I had anticipated.

No doubt in the years to come I will regret selling 11% of my holding… as TAST expands to beyond 200 sites and ends up being sold for a lot more than the 184p a share I received!

Maynard Paton

Disclosure: Maynard owns shares in Tasty.

Hi Maynard,

Great blog as always. I don’t hold TAST but was trying to figure out how you calculated the revenue per outlet for H1. If you annualise revenue of £21.8m across 12 months, and then divide the total by 52 outlets I get a figure of £838k per retail outlet.

Best wishes,

Imran.

Hello Imran

I used the average number of outlets for the period — i.e. 50, rather than the period-end number of 52. Slight adjustment for the extra week as well.

Maynard

Dear Maynard

You did not seem to dwell on the large impairment at Tasty. Is this because it’s good practice to promptly recognise these? They seem very big for just 5 sites and there seems to be no note to explain how they were calculated. Do restaurants accounts create ‘goodwill’ when they fit out leasehold sites based on a guesstimate and then revise this down if sites underperform?

I am still learning about the complexity of capitalisation (or not ) in the retail sector. It makes a big difference to ROC but seems to be quite opaque! Most retailers have operating leases that are off balance sheet but they add to assets any ‘leasehold improvements’ it seems. Your insight would be very helpful.

Best regards Dan

Hello Dan

On the write-offs, I wrote the following on another discussion board this morning which explains why I did not dwell too much on the subject:

“Yes, the write-offs were not great, but management has taken write-offs before.

Back in 2007, 2008 and 2009, sizeable impairments and disposals were also recorded as the original dimt chain failed to build momentum during the recession. You could argue that management had lost its touch then, but the board then changed tack to open Wildwoods and the group has done well since.

A new property director has been recruited recently. He is ex-Prezzo and oversaw the opening of 30 new restaurants a year. He ought to ensure future sites are properly located.

If you look at the history of Prezzo, it recorded write-offs or impairments every year between 2003 and 2014 except for 2004 and 2010. Those charges totalled £18m, though they did no real harm to long-term Prezzo holders and the upward share price. I think it is the nature of the industry that some sites will under perform.”

There rarely is any explanation as to how the write-offs are calculated. Such items are generally embarrassing for companies so the less said the better (at least for the directors). Investors on the other hand have to take a view whether the write-offs are hiding something sinister.

TAST’s £3.6m write-off indicates the average impairment per unit was £720k. That suggests to me the units were either a) recently opened (as £720k is a little above the £680k I was told it now costs to fit out a new unit), or b) one of TAST’s early London (dim-t?) locations (where fit-out costs were more expensive). I suspect it is more likely to be b) than a).

Restaurant accounts do not create goodwill when the company fits out leasehold premises. Instead, ‘leasehold improvements’ are created when expenditure such as plumbing, rewiring, tiling, interior wall/ceiling construction etc is performed. Such ‘long-life’ expenditure can be capitalised on to the balance sheet and then depreciated over time.

What has happened at TAST is the company has reviewed its sites, found 5 that appear to have long-standing problems and then written-down the value of the associated leasehold improvements — as the predicted future income from the sites concerned no longer justifies the earlier expense.

TAST has kept these 5 sites open, which may be because they still make a bit of money…or maybe because it has no choice.

The current accounting rules allow operating lease obligations to be accounted for off the balance sheet, although I believe that is to change in the next few years with such liabilities moving onto the balance sheet.

Maynard

Maynard,

Thanks for the reply above. Very interesting.

I was slightly disappointed that we didn’t get more detail on what the write-offs relate to (in particular, are the sites Dim-T, Wildwood, or a mix of the two?). On balance, though I agree with you that it is more likely that they relate to Dim-T sites. This was a view I formed yesterday but on admittedly a rather more speculative basis than your very thorough analysis. I think it unlikely that TAST would take a write down on recently opened restaurants unless trading was really dire there.

The roll-out schedule is a little disappointing, but at least they are still opening new sites and maybe we just have to accept it won’t be as fast as we had hoped. It could be that they will speed up in future, too, as and when the concept gains traction.

I agree there is good potential upside here and it really boils down to backing the Kayes. I can understand why you trimmed back, though. I only have a small position here myself.

Regards

Phil

Phil, thanks for the Comment — all fair points.

Maynard

Maynard,

Great update as always

Thanks

David

Thanks David.

Thank you for the update Mayn. It looks like you called it right, to sell a few ahead of the results being published as the SP has continued to slide since then. I am still a long term holder of Tasty, having bought in when you first highlighted it in CS Pro years ago, and it is still my largest holding. I do believe the Kaye family will work their magic with this company as they have with ASK and PRZ in the past. Thanks for keeping your eye on the ball with this share.

All the best

Jonathan (from CS Pro)

Thanks Jonathan.

As well Jonathan it’s also my largest holding in the the portfolio

David

Tasty (TAST)

Restaurant numbers:

Time for a quick check on restaurant numbers.

There are three brands: Wildwood, Wildwood Kitchen and dim-t.

http://www.wildwoodrestaurants.co.uk/restaurants/

http://www.wildwoodkitchen.co.uk/contact.html

http://www.dimt.co.uk/locations/

As at 24 October, these websites listed 52 Wildwood, 13 Wildwood Kitchen and 7 dim-t outlets.

I see the Wildwood website now lists the 13 Wildwood Kitchens as Wildwoods, so the group total is actually 39 + 13 + 7 = 59 sites.

My last count in September had 55 sites, so it seems a unit has opened in Llandudno, Conwy and another in Worcester Park, Surrey. Also, sites at Edinburgh and Bournemouth, Dorset are due to be open in November.

So at the moment, 57 units are open and 2 are about to be open.

TAST stated within the interims covered in the Blog post above:

“Four sites have been opened in the period, with a further three sites opened since the period end. The Group is currently undertaking construction on three sites and expects to start construction on at least a further four sites during Q4 of 2016.”

The further three sites opened since the period end were Crawley, Cheam and Lincoln. Of the seven sites either under construction or are expected to start construction, two have been opened and two will be open in November. So that leaves another three units to start construction before the end of the year.

Maynard

http://www.wildwoodrestaurants.co.uk/restaurants/

http://www.wildwoodkitchen.co.uk/contact.html

http://www.dimt.co.uk/locations/

Looks as if http://www.wildwoodkitchen.co.uk/ has now disappeared and the address points to http://www.wildwoodrestaurants.co.uk/

That makes life easier for the restaurant count.

TAST’s Kitchen units had slightly different menus to the main Wildwood sites, but that different menu is not shown on the Wildwood website. So I wonder if the Kitchen format is now being transformed into Wildwood.

Maynard

“My last count in September had 55 sites, so it seems a unit has opened in Llandudno, Conwy and another in Worcester Park, Surrey. Also, sites at Edinburgh and Bournemouth, Dorset are due to be open in November.

So at the moment, 57 units are open and 2 are about to be open.”

http://www.wildwoodrestaurants.co.uk/restaurants/

Now showing Edinburgh opening in December, plus outlets in York and Northwich (Cheshire) that are ‘Coming Soon’. Bournemouth still on for opening in November.

So at the moment, 57 units and now 4 about to be opened.

Maynard

Maynard,

Its steady progress and for the first time a step in to Scotland with Edinburgh. I visited Edinburgh in September (not Wildwood) and its a very happening City so a good location hopefully.

David

Hello David,

Yes, first step into Scotland. I have just checked on the Prezzo website and it has two sites in Edinburgh, one in Fife and four in Glasgow, so there is further opportunity north of the border for TAST I hope.

Maynard

Maynard,

Interesting news development today

The Company today announces that it has conditionally raised £9.0 million, before expenses, through a placing of 6,210,000 new Ordinary Shares (“New Shares”) at a price of 145 pence per share (the “Placing Price”) (the “Placing”). The Placing Price is at zero discount to the closing middle market price of the Company on 4 November 2016 (being the latest practicable date prior to this announcement). The Directors are pleased to confirm that the Placing was over-subscribed and supported by both new and existing institutional investors, as well as the Board.

It may have been a share price dilution but the fact that its over subscribed by institutional investors I guess is positive. How can that happen ? We as share holders get no notification of such an event and till after the fact! 9m is a big shot in the arm so that’s also encouraging and suggests greater acceleration (or support of)of restaurant openings.

Its interesting they have done this when the share price was low at 140p, maybe that was deliberate to entice investors.

Be interested in your thoughts Mayn

David

David

I’m pleased with this placing. I had already thought TAST had needed extra money for its plans for 15 sites for 2017, and this £9m — alongside cash flow from operations and money that can be still drawn down from the bank — ought to cover what’s needed for the next 12 months at least.

TAST had 57 sites open at my last count, so this £9m could I guess help open another 12 perhaps — an extra 21% to the estate. That seems a good deal when the placing adds ‘only’ 11% to the share count.

The institutions were taken ‘inside’ for the purposes of this deal, and these days ordinary private investors never get a look in on these transactions. Though the placing price was equal to the share price on the announcement, the share price had dropped during recent weeks… I suspect news of the placing price had leaked out.

At least Sam Kaye and two other directors are putting fresh money in, which gives us an indication of what they feel could be a good-value share price.

Maynard

Tasty (TAST)

Placing Document:

Here is the placing document:

https://dimt.co.uk/wp-content/uploads/2016/11/Park-final-circular-071116.pdf

Interesting snippet that was not contained within the original RNS release:

TAST now expects 62 outlets by the end of the year. So that suggests another site will be opened soon — in addition to the four currently under construction (Bournemouth, Edinburgh, York and Northwich).

Maynard

Maynard

Appreciate your comments, very interesting. The Kaye family have a significant stake so certainly positive indicators

Looks like 140p may prove to be a good buying point

David

Tasty (TAST)

Further thoughts on expansion funding

Following the recent Placing announcement, I have performed a few sums to determine how far TAST can expand its estate before requiring extra money.

I believe the group is funded fully until the end of 2017, at which point operating cash flow from the estate may not be enough to support the opening of an extra 15 restaurants a year. So perhaps an extra cash injection (through either extra debt or equity) may be required during 2018.

Anyway, here are my sums.

At June 2016, TAST had 52 sites open. The Placing document revealed the group expected 62 outlets to be open by the end of 2016 and a further 15 sites to be opened during 2017. So, an extras 25 outlets during the 18 months to December 2017.

Assuming TAST’s depreciation charge is a fair proxy for maintenance capital expenditure, I calculate each open restaurant incurs maintenance capex of £41k a year. So maintenance capex for the existing 52-outlet estate should be 52*£41k*1.5 = £3.2m during the 18 months to December 2017.

I calculate the capex cost of opening a new restaurant is about £700k. So expansion capex for the 18 months to December 2017 could be around 25*£700k = £17.5m.

Add the two numbers together and I arrive at £3.2m + £17.5m = £20.7m.

At June 2016, TAST carried cash of £2.6m and had £2m of debt facilities still to draw down. The Placing raised an extra £8.6m after costs. I am guessing operating cash flow from the business during the 18 months to December 2017 comes to £7m.

So… £2.6m + £2m + £8.6m + £7m = £20.2m of cash to spend on capex during the 18 months to December 2017.

True, £20.2m is £0.5m short of my £20.7m capex estimate, but it is close enough.

If TAST’s expansion plan all comes good, the group should have 77 sites trading at the start of 2018.

For 2018. I reckon total capex (expansion and maintenance) could be about £13m-£14m assuming 15 new sites wish to be opened that year.

Operating cash flow was £5m for 2015, and I just don’t see 77 sites generating anything close to £13m to pay for the required capex. So extra cash will be needed I reckon during the early part of 2018.

Maynard

Maynard

That’s an interesting snippet. I guess to have enticed the Institutional Investirs they wil have shared far more than us mere private investors get which is very annoying and in my view shows the unfairness of the system. The rich get richer quicker than we ever can.

I recall earlier they were looking at 20 for next year so 15 is a little lower but a better pace than this year which looks like being 12. 2015 was 11. Steady I would say but a bit disappointing the pace isn’t picking up.

Regards

David

In second thoughts I guess 15 restaurants next year on 62 planned for this year end is 24% increase so not shabby by any means!

David

Hello David

The directors said at the AGM that opening 20 a year was achievable in the next few years (I forget exactly what was said). I reckon the disappointing performance of some units (see the write-off in the interims) and the appointment of the new property director put the expansion on a brief hold during H1 of 2016, with only 4 sites opened in that period.

Anyway, it seems we are back on track (sort of), with 62 predicted by the end of 2016 (i.e. 10 opening in H2) and then a further 15 for 2017. There were 52 sites open at June 2016, so adding 25 on that is almost a 50% expansion in the next 18 months. Not too shabby as you say.

The net opening rate has been 5 units, 8 units and 12 units during 2013, 2014 and 2015, with TAST predicting 14 for 2016 and 15 for 2017. So the rate of expansion is accelerating, sort of.

Maynard

Tasty (TAST)

Further thoughts on valuation

Following the upcoming Placing, I have reworked my valuation sums.

Here is a recap of my thoughts from the original Blog post above:

“To put the upside possibilities into perspective, PRZ was acquired early last year for £304m when it operated with 245 restaurants, and that is the scale I hope TAST can one day reach (TAST is currently valued at £91m and operates with 55 restaurants).

That said, notable differences are now emerging between TAST’s current progress and PRZ’s growth record.

For example, PRZ never took on debt and bought some freeholds, while TAST has taken on debt and its estate is entirely leasehold.

If I adjust for PRZ’s freeholds, that ‘target’ market cap is reduced from £304m to £274m. And if I consider TAST’s debt, I really ought to be using the group’s current enterprise value of £98m to judge the possible upside.

So… whereas I could project TAST going from £91m to £304m and a possible 234% gain, a more conservative view perhaps is going from £98m to £274m and a potential 180% return. Accounting for TAST’s outstanding options would then reduce that 180% return further.”

The Placing will add an extra 6.21m shares to the share count, taking the total to 59,570,324. The market cap at 145p is therefore £86.4m.

I believe the proper way to assess TAST’s potential versus Prezzo is to i) include options in TAST’s share count (they come good on a takeover, as did PRZ’s options when it was acquired), and ii) adjust PRZ’s ‘target’ market cap for the freeholds the group sold very soon after it was acquired (i.e subtract £30m from £304m to get £274m).

I reckon current TAST outstanding options come to 3,519k. There were 4,164k options at the end of 2015, and various RNSes have indicated 145k have since been exercised. The Placing RNS revealed a further 500k had been exercised, too.

Therefore, a fully diluted TAST mkt cap is 145p * (59,570k shares + 3,519k options) = £91.5m.

Going from £91.5m to £274m is a 3.0x gain, or 11.6% a year assuming TAST’s transformation into PRZ takes 10 years.

There is also TAST’s debt to consider. PRZ never used debt, but I suppose TAST could be operating with debt if/when it becomes the size of PRZ — and that would dampen any take-out valuation and that possible 11.6% pa future return. Hopefully TAST’s debt will be paid down during the intervening years, but you never know.

I also wrote in the original Blog post above:

“Another notable difference beginning to emerge between PRZ and TAST concerns margins.

Back in 2005 when PRZ’s estate expanded from 48 to 72 sites, its operating margin was 15%.

In contrast, TAST’s margin appears unlikely to top 10% this year with between 50 and 60 sites. I just wonder if that lower margin may in time reflect a lower potential future value for TAST.”

The margin difference is due mainly to TAST employing more staff per restaurant than PRZ (20 vs 15). Staff are currently paid similar wages at each company, but I don’t know why TAST employs relatively more people. TAST’s restaurant staff absorbed 36% of revenue during 2015, but for PRZ the percentage was 30% for 2014.

Maybe more staff are needed because TAST’s sites are busier — revenue per site per annum was £852k at TAST for 2015, versus £766k at PRZ for 2014. But even so, the sites are not that busier to justify 33% extra staff per unit.

Maynard

Maynard,

As always very interesting analysis, thank you

It looks like Prezzo took 10 years to grow to 245 Restuarants from Tastys size as of today. Tasty is already 10 years old and at next years forecast rate of new openings at 15 it would take another 12 years to take the 62 outlets up to 245 if the Management does have a Prezzo sized business in mind

On another subject how do you feel about the current PE of around 32, is 145p therefore a fair valuation today and how much of the potential 180% increase in value is factored in ?

David

David

On another subject how do you feel about the current PE of around 32, is 145p therefore a fair valuation today and how much of the potential 180% increase in value is factored in ?

My sums suggest a further 180% upside — assuming TAST can grow into PRZ. That gain translates into about 11% a year assuming it takes 10 years. I think that is a fair potential return given the long timescale involved, but whether that is enough to buy more shares — I am not sure. I’d say the market is projecting in some of the long-run upside possibilities, but not overly so. I’d add that the market is not pricing in any roll-out stagnation or disaster.

It was much easier to decide when the shares were sub-100p and the forecast upside was 15%/year or more. At that point, there was more room for error should things not work out as hoped.

Something I should have mentioned in the earlier Comment today was that I feel TAST still needs extra cash to expand from 2018, so a further placing could dilute the share count and potential returns further.

Maynard

Thanks Maynard. Of course up till last year some of the Kate’s where still busy with Prezzo but now they have Tasty to focus on. I wonder whether another chain might be introduced at some point!

David

David — check out recent developments at Richoux (RIC).

Maynard

Maynard

That’s interesting! Certainly looks like RIC needs help with stagnant revenues and falling profits. maybe a turnaround opportunity with substantial investment by the Kaye’s but possibly a distraction for us Tasty shareholders.

You did well to spot this link Maynard!

David

This one piqued my interest because it hit a 52 week low, then I remembered you were a fan so I took a closer look.

First of all, I spotted what looks like an error in the consolidated cash flows for the most recent interim, the 1,526 is the one that tallies up at the bottom of the table, the 1,366 number tallies with nothing. Small potatoes, but sloppy.

https://s18.postimg.org/5rr76zjk9/Capture.png

After looking at the accounts, then reading your post again, you make several excellent points on how this business model isn’t as strong as Prezzo. The lower operating margins at Tasty look structural to me and it’s fair to presume they will stay (I am sure they wouldn’t have those extra staff if they weren’t needed). I can live with that operating margin, but what really worries me is that it looks like the marginal return on new locations has declined. If the roll-out model is starting to run out of steam at 50 locations – how do we get to 250? Management are proven, talented, and have their own money at stake, but past performance is no guarantee. Finally, as you state, the use of debt and the issuance of shares is also a concern. It seems like every one location that the company can self fund, they’re going to use debt/new equity to fund the other two. Assuming you get to 250 locations in 10 years, how many of them will be out of your own pocket?

To me, it seems like you’ve laid out some very good reasons to not invest in Tasty. I feel that your mooted 11% annualised return just isn’t enough considering the risks here. If at any stage the roll-out model is in jeopardy, then I can see this losing half its value like Crawshaws did.

Sorry to be the glass half empty on this one. I hope I am proven wrong because I do appreciate all the fine articles that you put together.

Hello Tabhair

Thanks for the Comment and apologies for the delayed response. Good spot on the sloppy number.

I can live with that operating margin, but what really worries me is that it looks like the marginal return on new locations has declined. If the roll-out model is starting to run out of steam at 50 locations – how do we get to 250? Management are proven, talented, and have their own money at stake, but past performance is no guarantee.

I don’t think the roll-out is starting to run out of steam. I noticed that only 4 new outlets were opening during H1 this year and I think the expansion had to pause for breath because of a mix of:

i) certain sites had under performed and management had to resolve the issues there, and;

ii) a new property director had been appointed (ex-Prezzo) and presumably he came with new roll-out plans.

The Placing details suggested 14 new sites will be opened for 2016, and 15 for 2017. This year started at 48, so the scale of the roll-out is not insignificant at present.

Essentially this is a bet on the Kayes turning TAST into the size of ASK and Prezzo — but perhaps the economics of TAST won’t be as great as those two forerunners.

Finally, as you state, the use of debt and the issuance of shares is also a concern. It seems like every one location that the company can self fund, they’re going to use debt/new equity to fund the other two. Assuming you get to 250 locations in 10 years, how many of them will be out of your own pocket?

Good question — I don’t know for sure. TAST reckons self-funding will occur at 100 units. I reckon the firm has enough money to get to the end of 2017 (77 units), but then the numbers become a little hazy for outsiders to judge. Maybe by then more debt could be taken on, or maybe not. I have to trust the management here that things will work out alright.

To me, it seems like you’ve laid out some very good reasons to not invest in Tasty. I feel that your mooted 11% annualised return just isn’t enough considering the risks here. If at any stage the roll-out model is in jeopardy, then I can see this losing half its value like Crawshaws did.

I always like to look at the downside of each investment, just in case. A bias most of us suffer as investors is to ignore problems and just look at the positives. I guess this approach means my posts sometimes read as if I should never own a share at all.

With TAST, I am not actually buying more at present. But I am happy to hold. I may buy more if the price falls further. Agreed, if the roll-out does actually run out of steam, then the price will be hammered.

Sorry to be the glass half empty on this one. I hope I am proven wrong because I do appreciate all the fine articles that you put together.

I don’t mind ‘half-empty’ Comments. They prompt me to think a bit more about my investments, and that’s why I do this Blog.

Maynard

Tabhair,

You make some excellent points.

I do hold Tasty (albeit only a very small position) – and in fact the reason it’s not a large position is that I do have some doubts about the investment case. Obviously it is attractive to back the Kayes but I am starting to wonder whether the combination of issues identified by both you and Maynard (margins, incremental returns…) means the risk is at least as much to the downside here.

Another thing that concerns me is that the environment now is far more competitive than it was when ASK and Pizza Express were establishing themselves (or at least so it seems to me). There are a far greater ranger of interesting places to eat and it’s going to be much harder to establish a business based on a somewhat me-too pizza/pasta/burgers offering (http://www.wildwoodrestaurants.co.uk/wp-content/uploads/WW-Main-Menu_20.4.16.pdf). What is it that makes Tasty’s offerings stand out?

Regards,

Phil

Phil

What is it that makes Tasty’s offerings stand out?

I haven’t been to that many Wildwoods but when I have we found the service to be top notch which is unusual in my experience. The Food is good and the dishes feel like they have been freshly prepared. The Restuarants are tastefully done. Does this all amount to a differentiator I don’t know but the Kaye family have strong experience and a good track record

Regards

David

David,

Thanks – that is interesting and useful.

I think what you say could well amount to a differentiator – consistently good products and consistently good service should be enough to make Tasty stand out, in my view. There isn’t a WIldwood near me but I’ll make sure to try one when I get the chance.

Rgds

Phil

Tasty (TAST)

Further thoughts on the Placing and comparisons with Prezzo (PRZ)

I thought I’d double-check the history of PRZ to see what its valuation was like when it raised money via placings. It make may an interesting comparison with TAST’s recent placing.

I’ve looked at two PRZ placings:

i) 2004: http://www.investegate.co.uk/prezzo-plc–prz-/rns/issue-of-equity/200406110800036605Z/

ii) 2006: http://www.investegate.co.uk/prezzo-plc–prz-/rns/issue-of-equity/200602201156216446Y/

The 2004 placing occurred when PRZ had 36 restaurants and the 2006 placing occurred when PRZ had 73 restaurants.

(PRZ became self-funding after the 2006 placing, and so no further placings were required.)

These two PRZ placings are the best comparisons to TAST with its 57 sites at present.

There’s a bit of working out to do with these PRZ placing RNSs to determine the then market caps.

2004:

This RNS says 26,456,910 shares owned by Philip Kaye represented 50.04% of the enlarged share count. As such, the enlarged share count was 52,871,522 shares. The placing price was 120p.

So the market cap at the time was £63m (52.8m * 120p) post-placing with 36 sites.

2006:

(By now PRZ had subdivided its shares by 4)

This RNS says 12.5m shares were issued at 60p, and that the new shares represented 5.9% of the prior share count.

So, the prior share count was 12.5m/5.9% = 211,864,400 shares. Add on the 12.5m new shares and the enlarged share count = 224,364,400 shares.

So the market cap at the time was £135m (224.4m * 60p) post-placing with 73 sites.

Returns

PRZ was sold in early 2015 for £303.5m and there was about £4m paid as dividends between the placings and the sale.

Turning £63m/36 sites into £307m/c250 sites over 11 years = a 16% CAGR.

Turning £135m/73 sites into £307m/c250 sites over 9 years = a 10% CAGR.

TAST currently has a £86m market cap, or a £94m enterprise value (i.e. with debt added on), and 57 sites.

So it seems to me TASTs size now is roughly in the middle of the sizes of PRZ at those two placings. Maybe TAST’s future CAGR will prove to be in the middle, too.

What is also notable from looking at PRZ’s history is that its freehold estate went from £10m to £30m from 2006 to 2015.

I have cautiously assumed TAST would never have the benefit of freeholds, and always looked at PRZ’s valuation without freeholds.

But PRZ’s ability to splash £20m on freeholds between 2006 and 2015 is significant — maybe when TAST starts to become self-funding, it too may then produce a lot of surplus cash to splash about.

Maynard

Maynard,

Interesting comparison

Thanks

David

Tasty (TAST)

Restaurant numbers:

Time for a quick check on restaurant numbers.

There are two brands: Wildwood and dim-t.

http://www.wildwoodrestaurants.co.uk/restaurants/

http://www.dimt.co.uk/locations/

As at 28 November, the websites listed 54 Wildwood and 7 dim-t outlets = 61 sites.

Of the 54 Wildwood locations, Edinburgh, York and Northwich are due to open soon. Bournemouth has recently opened.

So, a total of 58 sites are in operation at present. The recent Placing document said 62 sites would be trading at the end of the year. So one more site in addition to Edinburgh, York and Northwich is required.

Maynard

Tasty (TAST)

Restaurant numbers:

Time for a quick check on restaurant numbers.

There are two brands: Wildwood and dim-t.

http://www.wildwoodrestaurants.co.uk/restaurants/

http://www.dimt.co.uk/locations/

As at 23 December, the websites listed 54 Wildwood and 7 dim-t outlets = 61 sites.

Of the 54 Wildwood locations, I see Edinburgh, York and Northwich have now opened.

So, a total of 61 sites are in operation at present. The recent Placing document said 62 sites would be trading at the end of the year. Unless another unit opens during next week, or I have missed a unit operating under a different brand — it seems TAST will have missed its target.

Maynard

Interesting activity yesterday for Tasty as the new shares came in to play and the key Management also topped up nearly 2 million purchases which gave an unusually sky high peak in daily volume. I also noted that one of the Kayes sold a fair chunk, hopefully for Christmas shopping rather than a reflection of how he says the company moving! Despite this the share moved just +5% and is bobbing around at a year low level. The stock has certainly been hard hit this year down around 25% so year end results will be key to restore some confidence

David

Hi Maynard,

The TAST share price continues to drop on small volumes against no news from what I can see. The PE is now 28. Can I ask your view what you think a fair PE would be at this stage assuming that TAST did achieve the growth to 250 restaurant’s over the next 10 years ? I guess I’m asking myself is this is a good buying opportunity ahead of the year end results in circa April time ?

Thanks

David

Hello David

I don’t look at P/Es for TAST…as noted in the original Blog post above, I compare TAST’s mkt cap (with some adjustments) with that of Prezzo when the latter was acquired for £274m.

With TAST at 130p, the mkt cap with all options exercised is £82m. If that £82m is turned into £274m over ten years, the potential annual return is almost 13%.

Is that near-13% return enough to offset the risk of the roll-out going wrong in the meantime, or the economics of TAST’s outlets never matching up to those of PRZ?

While I would not say the shares are a no-brainer bargain, the possible rewards now are becoming much greater in my view.

Also…I looked briefly at Fulham Shore recently. It operates a number of Franco Manca pizza outlets.

I wrote this on a different website:

“The most remarkable feature of FUL’s accounts is its lease cost — just £1.3m for 2016 for 29 (at year-end) units (mostly in London) producing revenue of £29m.

A rival quoted chain has lease costs at 11% of revenue (vs FUL’s 4.5%), and yet produces lower revenue per unit (<£900k vs £1m+ for FUL).”

The rival quoted chain was TAST. I get the impression FUL (and maybe others) are doing well with smaller pizza premises and cheaper pizzas, and serving lots of diners to keep sales high and rent costs low. From a quick first look it seems FUL’s dining concept has merit. I would still back the Kayes as the more dependable management though.

Maynard

Maynard,

Thanks for your thoughts, I would be happy with a 13% return per annum for sure accepting the risks as you point out

Wildwood et al is more upmarket than that of FUL but yes I agree it doesn’t make it correct when you are trying to maximise margins so looks like there is a price to pay

If I pro rata your numbers at today’s number of Restuarants with ‘little hope’ priced in I calculate a share price of around 100p so they look pretty good value to me

Regards

David

Maynard,

Either you have a lot of followers on this Blog who took your word yesterday or we are both genius given the nice jump in TAST today, 9% as I write this

Best

David

David

It could be my site….but a rise like this on a Friday morning looks like a typical Investors Chronicle tip.

Maynard

My wife and I have just conducted a little further market research. We recently visited the wildwood in York which has only just opened. People were queuing to get in. The waitress told me the place was full every day.

Then we went to the WW in Stratford on Avon and had a very decent meal once again. Once again the waiter said the restaurant was full every evening, and we certainly observed many happy diners, ourselves included!

Last week I noticed a sign in an empty shop in Bicester saying that wildwood are opening there soon.

I have also booked a table for us both in the DimT in Winchester for February half term!

I continue to be pleased with my, now 9 year, investment into Tasty. I may even buy a few more.

Best wishes Mayn.

Jonathan

Hello Jonathan,

Thanks for the Comment and scuttlebutt report. It is reassuring to know that one of the new openings and one of the more established units are both doing well. You could be forgiven for thinking the restaurants were empty judging by the recent share-price weakness. FYI, the forthcoming unit at Bicester has just been added to the website: http://www.wildwoodrestaurants.co.uk/restaurants/. I trust you enjoy your Winchester dim-sum!

Maynard

Hi Jonathan,

Thanks for sharing, I too and my family have had recent pleasant experiences in London

David

Tasty (TAST)

Restaurant numbers:

Time for a quick check on restaurant numbers.

There are two brands: Wildwood and dim-t.

http://www.wildwoodrestaurants.co.uk/restaurants/

http://www.dimt.co.uk/locations/

As at 03 February, the websites listed 55 Wildwood and 7 dim-t outlets = 62 sites.

The latest unit to open is a Wildwood at Bicester.

Maynard

Tasty (TAST)

Restaurant numbers:

http://www.wildwoodrestaurants.co.uk/restaurants/ now showing a unit in New Street, Birmingham, opening soon.

Maynard

Tasty (TAST)

Restaurant numbers:

http://www.wildwoodrestaurants.co.uk/restaurants/ now showing the unit in New Street, Birmingham, has opened. I think that makes a total of 63 sites.

Maynard

Maynard

I visited Canary Wharfe last weekend with the family and found food and service to be excellent. It’s location is well placed but surrounded by competition – Nando’s, Wagamumma and others. When I talked the Manager on differentiation he said they were the only ones offering service at the table. This probably adds overhead staffing costs but made for a good experience.

David

Ps Share price continues to drop on no news as far as I can see.

Hi Maynard,

My recent experience at the Dim T in Winchester was very positive, as were the two wild woods I have recently been to. All three restaurants have been full and the staff tell me that is normal.

But the SP continues to drop lower and lower. Do you think this is simply because of no news, or do you think there is a general fear of the results to be published soon? ( is it March they are published?). Is it another buying opportunity do you think?

Thanks

Jonathan

PS hi to you David too!

Hello Jonathan and David,

Thanks to both of you for the Comments. It is encouraging to hear your positive scuttlebutt from the front line.

The share price continues to drop…I can only assume there is a clumsy seller in the background. Last year’s FY results were issued in March, so about a month to go before we ought to know more details. I guess worries about last year’s sales ‘blip’, greater costs from the Living Wage/higher business rates, etc, may be influencing the share price. I just don’t know. Famous last words, perhaps, but there is nothing as yet to suggest the Kaye family has lost its touch and TAST’s roll-out will be anything other than successful long term.

Maynard

Thanks for your reply Maynard. I guess we await the results in the next month or so before taking further action. This has always been a share that is based around the success of the Kaye family, and as you say, there is nothing at the moment to cause us to lose our confidence in their abilities.

Many thanks

Jonathan

Shares going up today. Bottom in?

I guess if we really believe, we should be buying.

It’s been a shocker drop in recent weeks and as you say today is all up but on no news as far as I can tell.

I still think it’s got a strong future and therefore it’s now at a great price but don’t act on my words folks

David

Oh dear. Share price hit hard this morning after the preliminary results. I guess the fact that they anticipate more difficult trading this year to last has knocked confidence in this share. I look forward to hearing your take on this Maynard in the days ahead.

Still holding, but feeling slightly less sure than I did a few days ago.

Atb

Jonathan

Hammered, they say they will have a strategic review which suggests the thesis has flaws is my reading

Looking forward to your take Maynard

David

David,

Yes I agree with you. I actually sold my shares at the start of the year, thankfully – blind luck really as I certainly didn’t have any sense of impending poor trading.( In fact, I sold because (1) TAST was a small position which I didn’t want to add to, and I don’t want a long tail of small positions; and (2) I was worried more generally that the restaurant / casual dining sector is now considerably more competitive than when the Kayes established their previous chains. There are a large number of attractive options these days and I could not see what made TAST stand out.)

But it’s now very difficult (to me at least) to work out whether the shares are a good prospect or not – you’re really betting only on the Kayes’ managerial prowess.

Rgds

Phil

Phil

Very well judged wish I had pulled out

Suspect it’s over done now but that assumes management can stop the impairment charges this year and I’m guessing a strategic view means not!

Might look different t in a couple of years

Regards

David

Sadly this has gone from my one time all favourite share (I originally got in at 23p a number of years ago) to one that I am now very concerned about. I am unsure whether I should hold in the hope that the Kayes can turn this around – or whether it is time to take my profits and leave?

Regards

Jonathan