Last updated: 18 March 2019

By Maynard Paton

Note: This study of share options is not yet complete. Existing content may be subsequently updated and new content will be regularly added.

This guide will teach all you need to know about share options — what they are, how they work and why investors should evaluate them.

Contents

- Introduction to share options and why investors should evaluate them

- How do share options work?

- Different option schemes

- Share options in an annual report

Safeland: A good example of a bad option scheme- Somero: An example of understated share-based payments

Introduction to share options and why investors should evaluate them

- A share option is the right to buy an ordinary share at a certain price in the future.

- Options are typically granted to help recruit, retain and motivate company directors and employees.

- Options enjoy a greater value if the share price rises and, in theory, ought to align the interests of the option holder with the interests of outside shareholders.

- Investors should evaluate company options to check:

1) Dilution: Options can convert into ordinary shares and therefore increase the share count. Existing shareholders and per-share measures such as earnings per share can therefore be diluted.

2) Generosity: Companies can grant lavish option packages to executives that effectively provide significant rewards for mediocre performances. Such option grants may signal the directors care more about their own interests than the interests of outside shareholders.

3) Cost: Options are expensed against company earnings. However, the charge can both understate and overstate the real-life cost of the options and therefore distort accounting profits and share-price valuations.

How do share options work?

- Directors and employees can generally exercise their options — that is, convert their options into ordinary shares — after a pre-defined vesting date.

- The time between the option grant and the vesting date is known as the vesting period.

- UK companies usually grant options with a vesting period of three years and a contractual life that extends for the following seven years.

- Companies often — but not always — attach conditions to options.

- A typical condition is the company achieving a certain level of earnings per share growth during the vesting period.

- An option that has met its required performance criteria (if any) during the vesting period is said to have become exercisable or have vested.

- If an option has vested, the option holder must exercise the option during the option’s contractual life. The option will other otherwise lapse, and expire worthless.

- Every option has an exercise (or grant or strike) price, which is usually the price of the ordinary shares at the time of the grant — but could be any figure including zero.

- An option with a zero exercise price is often called a nil-cost option.

- Once vested, an option is exercised by the option holder paying the option’s exercise price to the company in return for an ordinary share.

Example:

An option is granted with an exercise price of 20p and subsequently becomes exercisable.

The option holder pays 20p to the company to exercise the option, and the company in return issues an extra ordinary share to the option holder that is currently worth, say, 50p.

The gain on the option to the holder (before tax) is therefore 30p (the share price less the exercise price).

- Options are granted with an exercise price that is fixed throughout the option’s vesting period and subsequent contractual life.

- However, companies can cancel options and re-issue them with a lower exercise price if the share price has fallen well below the original exercise price. Such behaviour is viewed unfavourably by shareholders.

- Employees generally forfeit their options should they leave their employer (although directors may be able to exercise their options depending on their negotiated leaving terms).

Different option schemes

- Share options granted by UK companies fall into two main categories:

- Approved, and;

- Unapproved.

- Approved options are those granted through one of the following HRMC-approved schemes:

- Save As You Earn (SAYE)

- Company Share Option Scheme (CSOP)

- Enterprise Management Incentive (EMI)

- These schemes enjoy certain employee tax benefits, although the value of the options that can be granted within such schemes is limited by HMRC. The limits prevent these schemes from causing major shareholder problems.

- Unapproved options are those granted outside of an Approved scheme and therefore do not attract any tax benefits. However, such options can be granted in any number and with any exercise price, and are therefore most likely to cause shareholder problems.

- The UK Corporate Governance Code caps the potential number of shares under option to 10% of the company’s issued share capital. However, companies do not have to comply with the Code.

- Unapproved options are awarded through company-specific schemes, with such schemes commonly named Long-Term Incentive Plans (LTIPs) or Executive Share Option Plans (ESOPs).

Share options in an annual report

- A company’s annual report is needed to judge whether options may cause problems to shareholders.

- The annual report will reveal:

- The number of ordinary shares in issue

- The total number of options granted and their exercise prices;

- The number of director options granted and their exercise prices;

- The dilutive effect of options on earnings per share

- The accounting cost of options.

- The 2018 annual report from Tristel is used as an example:

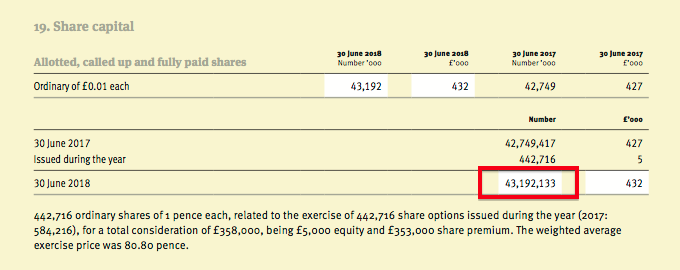

1. The number of ordinary shares in issue

- Look for the accounting note called Share capital (or similar).

- The note should refer to allotted, called up and fully paid shares (or similar) and show the number of shares in issue at the year end:

- In this example, 43,192,133 shares are in issue.

2. The total number of options and their exercise prices

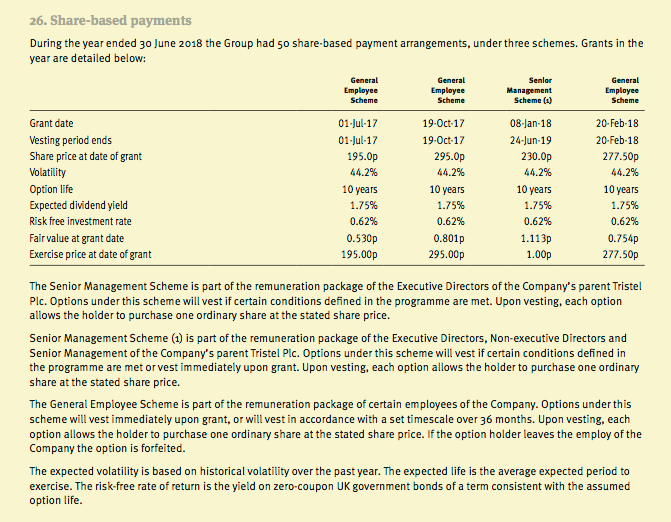

- Find the accounting note called Share-based payments (or similar).

- The note may contain a table similar to this, listing of grant dates, vesting periods, and so on, for options granted during the year:

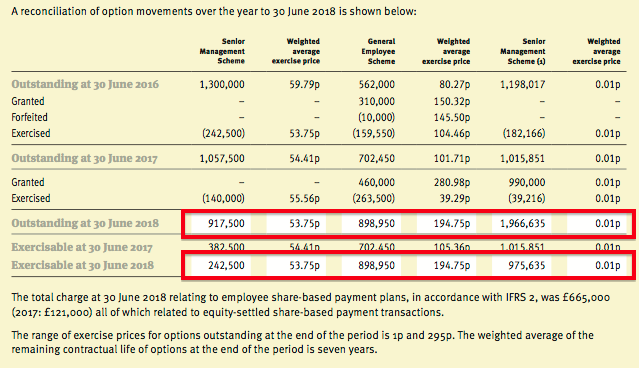

- The note should also reveal the total number of options outstanding and exercisable, and their associated exercise prices:

- In this example, three option schemes are in place and their respective totals (917,000, 898,950 and 1,966,635) have to be added together to arrive at an overall 3,783,085.

- The weighted average exercise prices for the schemes range from 1p to 194.75p. (Note: The right-hand-most column within the extract above should state 1p and not 0.01p).

- The average weighted exercise price of all 3,783,085 options is 60p ((917,000*53.75p) + (898,950*194.75p) + (1,966,635*1p)) / 3,783,085)

- Annual reports sadly do not always reveal the exact vesting conditions.

- The following is disclosed within Tristel’s annual report:

“The Senior Management Scheme is part of the remuneration package of the Executive Directors of the Company’s parent Tristel Plc. Options under this scheme will vest if certain conditions defined in the programme are met.

The General Employee Scheme is part of the remuneration package of certain employees of the Company. Options under this scheme will vest immediately upon grant, or will vest in accordance with a set timescale over 36 months.

Senior Management Scheme (1) is part of the remuneration package of the Executive Directors, Non-executive Directors and Senior Management of the Company’s parent Tristel Plc. Options under this scheme will vest if certain conditions defined in the programme are met or vest immediately upon grant.”

- Options granted with Tristel’s General Employee Scheme appear to vest without any performance conditions.

- However, options granted within the two senior management schemes vest on “certain conditions” not specified in the annual report.

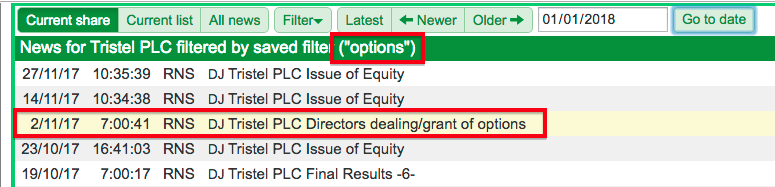

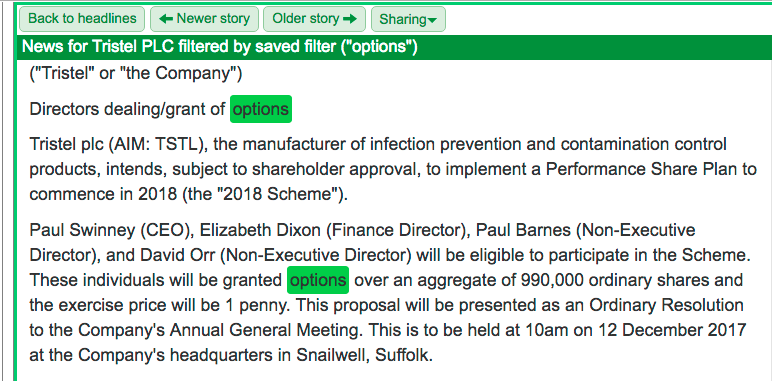

- Further investigation is required. SharePad can be used to quickly search for company statements containing the word “option”:

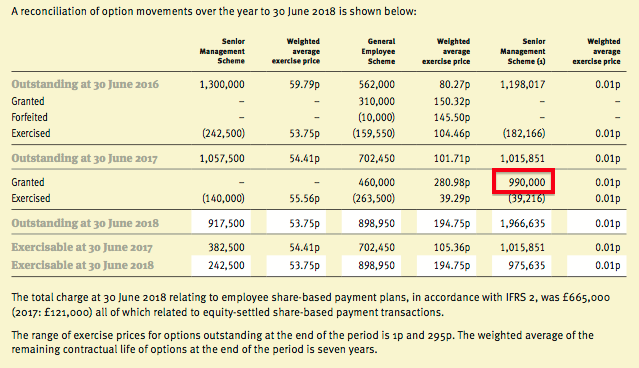

- The statement declared:

“The 2018 Scheme will be put forward for approval by shareholders at the Company’s Annual General Meeting. If the 2018 Scheme is approved 990,000 share options will be granted on 1 January 2018.

The options will be exercisable at 1 penny per share and will vest in three equal tranches as follows:

* One-third will vest upon the achievement of a share price of 350p

* One-third will vest upon the achievement of a share price of 425p

* One-third will vest upon the achievement of a share price of 500p

To vest, the average share price of Tristel plc must be above the hurdle rate for a minimum three-month period.”

- The 990,000 options granted were shown within the annual report:

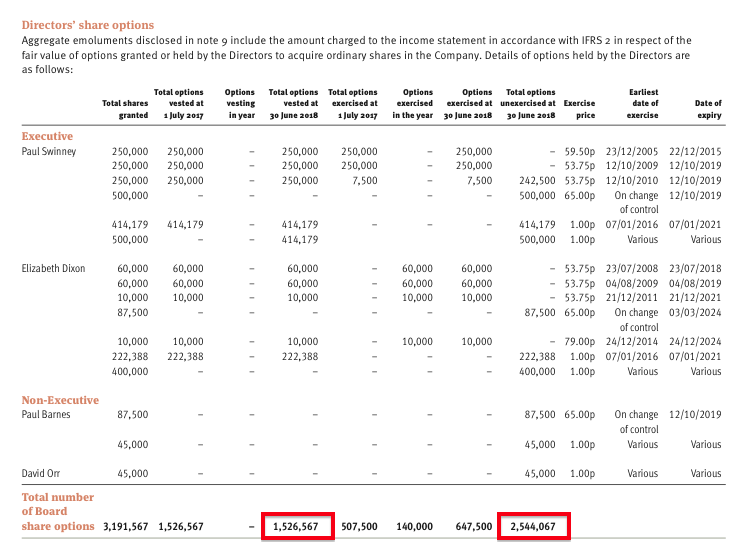

3) The number of director options granted and their exercise prices

- Find the directors’ remuneration report, and then the table listing the options held by directors:

- In this example, the directors own 2,544,067 unexercised options, of which 1,526,567 had vested.

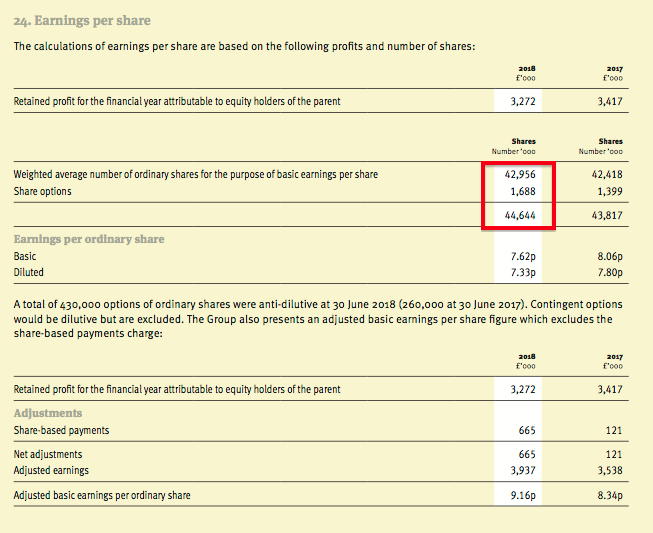

4) The dilutive effect of options on earnings per share

- Look for the accounting note called Earnings per share.

- The note will declare the weighted average number of ordinary shares, and make an adjustment for dilutive share options to then declare the weighted average number of ordinary shares for diluted earnings per share:

- In this example, the weighted number of ordinary shares is 42,956,000, the number of dilutive share options is 1,688,000 and the weighted average number of ordinary shares for diluted earnings per share is 44,644,000.

- The number of dilutive share options is calculated as at the balance-sheet date, and is based on the number of vested options outstanding that carry exercise prices lower than the share price.

- The number of dilutive share options is then reduced through a theoretical share buyback based on the share price and the theoretical proceeds received from the dilutive options.

- A simple calculation of dilutive share options is shown below.

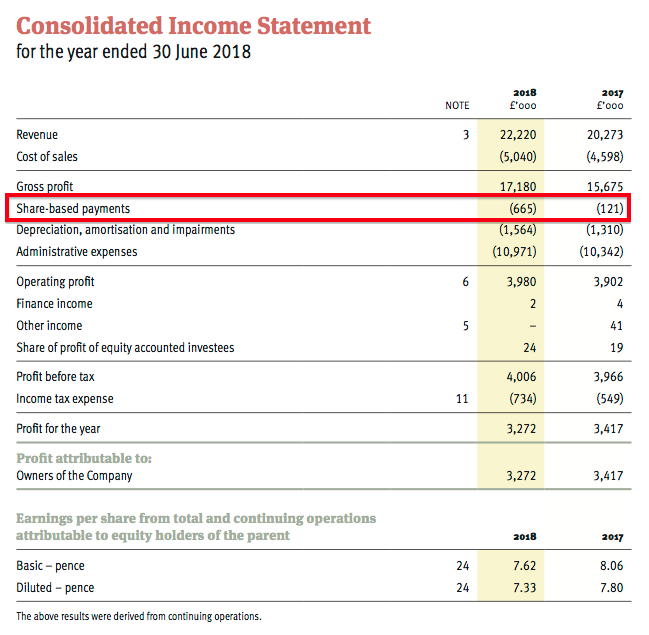

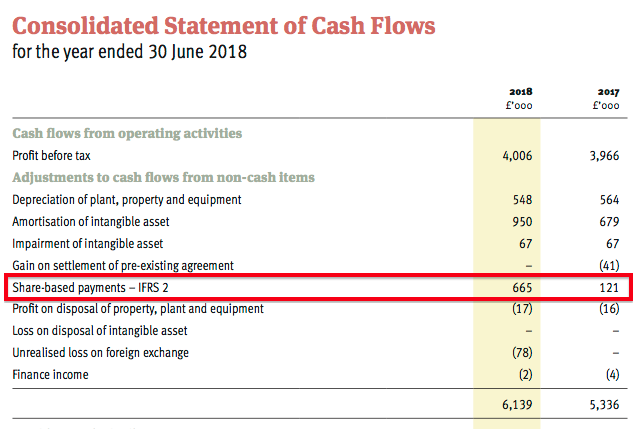

5) The accounting cost of the options

- Share-based payment is the accounting entry to find within the annual report. This amount reflects the accounting cost of the company’s options based on accounting standard IFRS 2, and is charged against earnings.

- Some companies may show share-based payment within the main income statement:

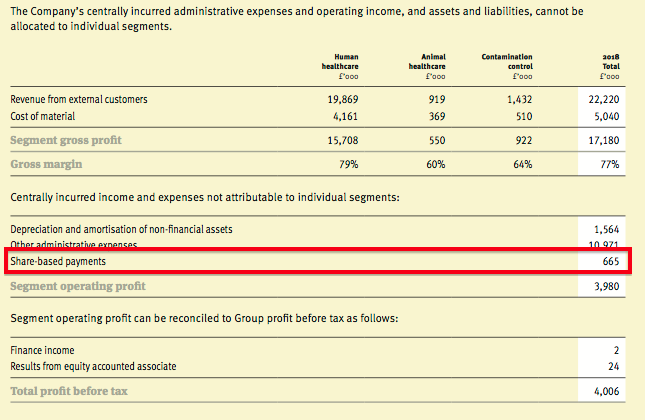

- In this example. the share-based payment charge reduced operating profit by £665,000 to £3,980,000.

- The share-based payment may also be found within the cash flow statement:

- …and within the note about central costs or charges against profits…

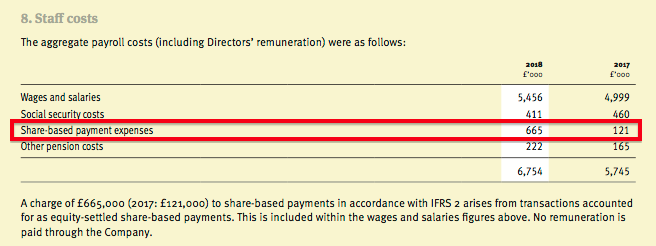

- … and/or within the note about employee costs:

- The share-based payment charge is calculated using complex mathematical formulae — Black Scholes and Monte Carlo.

What we have learned

- From this Tristel example we can determine:

- Total options represent 8.8% of the share count (3,783,085 / 43,192,133)

- Total director options represent 5.9% of the share count (2,544,067 / 43,192,133)

- Dilutive share options represent 3.9% of the weighted average share count (1,688,000 / 42,956,000).

- The accounting cost of the options represent 14.3% of the pre-option-cost operating profit (£665,000 / (£3,980,000 + £665,000k))

- Should shareholders be concerned?

- Other companies ought to be evaluated to provide greater perspective.

Safeland: A good example of a bad option scheme

Safeland (SAF), a small property company, provides a case study of an excessive option scheme.

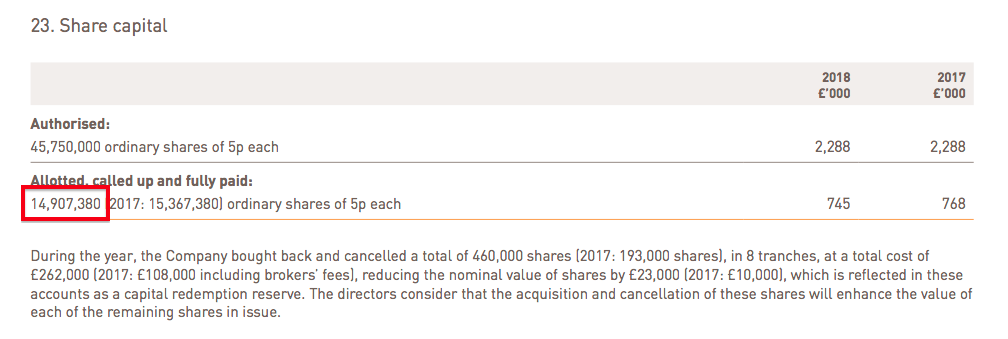

14,907,380allotted, called up and fully paid shares (that is, the number of shares in issue).

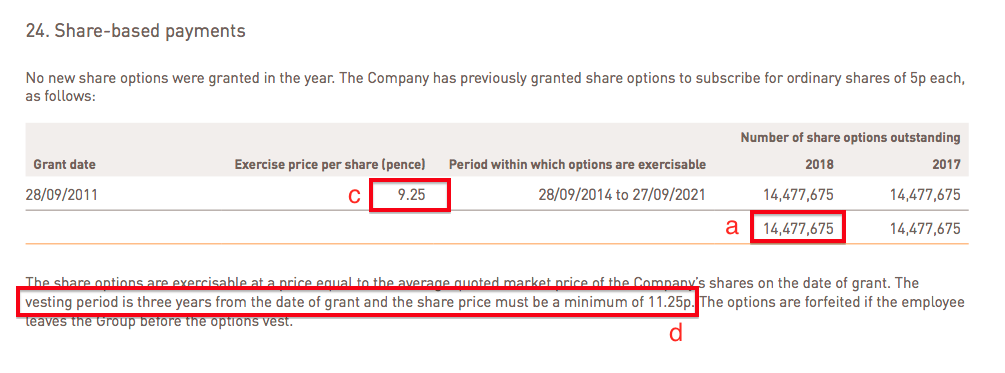

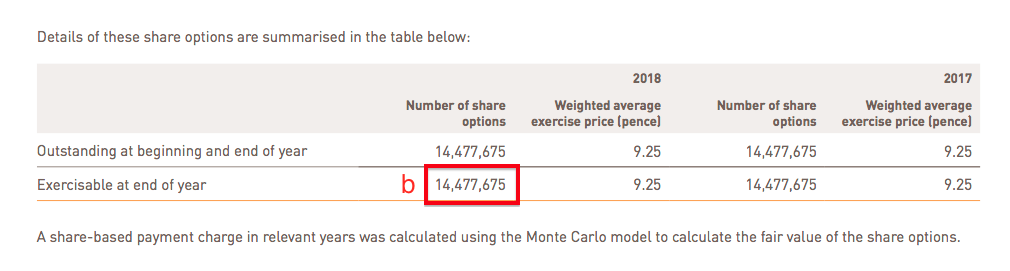

14,477,675share options outstanding (a) and exercisable (b), with an exercise price of9.25p(c). The vesting period is three years from the date of grant (that is, up to 28 September 2014) and the performance condition is the share price being at least11.25p(d).

The number of options granted represents an enormous 97% of the number of share in issue. If/when the options are exercised, the number of shares in issue will almost double.

As at February 2019, the vesting period had passed, the share price was 40p and therefore all of the shares were exercisable.

The performance criteria — the share price reaching 11.25p after standing at 9.25p at the time of the option grant — does not seem too demanding.

Further reading of the annual report shows:

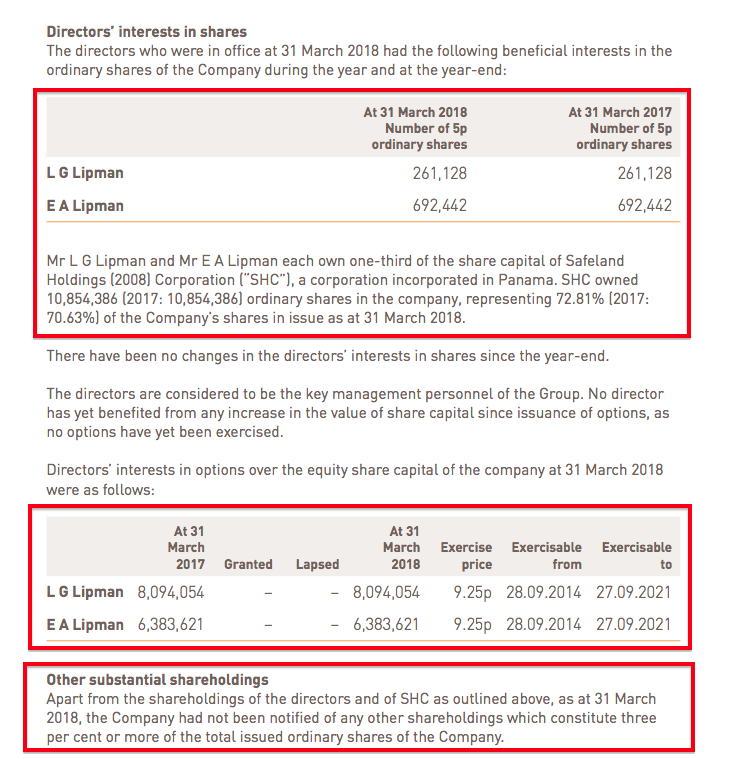

The directors, through their personal shareholdings and a Panama-registered corporation, control approximately8.1 million shares(or 54% of the number of shares in issue).

The directors own a total of14,477,675options — equal to the number of options outstanding.

If/when the options are exercised, the directors will own approximately 22.6 million shares — or 77% of the enlarged 29.4 million share count (14,907,380 existing shares plus 14,477,675 options).

The option grant would appear a straightforward way of taking greater control of the company.

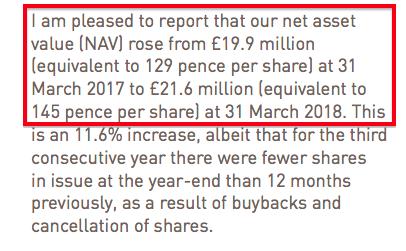

The likely dilution will have a significant effect on per-share measures. Safeland reported net asset value (NAV) within the 2018 annual report like this:

NAV of £21.6m divided by the enlarged 29.4 million share count would give NAV per share of 73p per share — versus the 145p per share declared.

The 40p share price perhaps reflects the substantial dilution prospect and the greater control the directors may soon obtain.

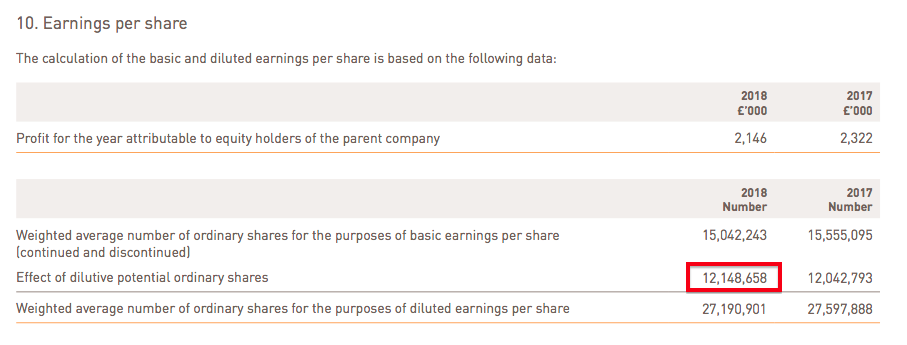

Safeland reported 12,148,658 dilutive share options.

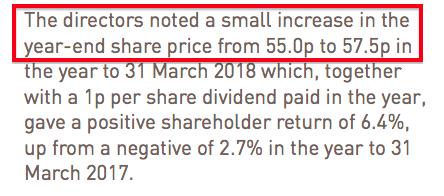

The 12,148,658 figure was calculated by multiplying the number of vested options (14,477,675) by their exercise price (9.25p) to arrive at £1,339,185.

The £1,339,185 was then divided by the year-end share price (57.5p) to theoretically fund a share buyback purchase of 2,329,017 shares.

The number of vested options (14,477,675) less the theoretical share buyback purchase (2,329,017) gives the number of dilutive share options (12,148,658).

Somero: An example of understated share-based payments

- Somero (SOM), a manufacturer of concrete-levelling machinery, provides a case study of reported share-based payments understating the true cost of options.

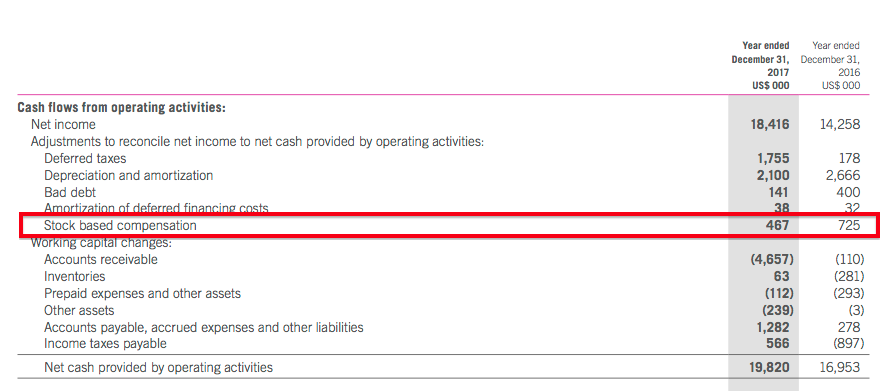

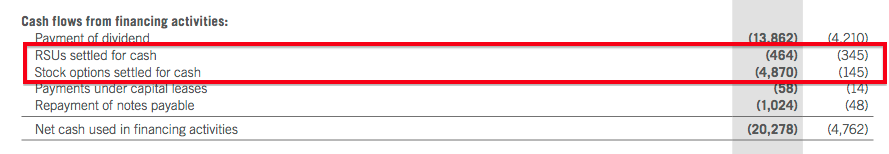

- Somero’s cash flow statement within the 2017 annual report show stock-based* compensation of $467,000 for 2017 and $725,000 for 2016:

- The same cash flow statement shows RSUs** settled for cash and stock options settled for cash totalling $5,334,000 for 2017 and $490,000 for 2016:

(*Somero is a US company traded on AIM. **RSU stands for restricted stock unit and is a form of option.)

- The table below lists the same figures, alongside earnings, back to 2010:

| Year | Stock-based payment ($k) | RSUs settled for cash ($k) | Stock options settled for cash ($k) | Earnings ($k) |

| 2010 | (50) | - | - | (2,224) |

| 2011 | (90) | - | - | (2,334) |

| 2012 | (166) | - | - | 1,020 |

| 2013 | (177) | - | (524) | 5,380 |

| 2014 | (262) | (4,874) | (1,036) | 14,541 |

| 2015 | (197) | (275) | (250) | 11,550 |

| 2016 | (725) | (345) | (145) | 14,258 |

| 2017 | (467) | (464) | (4,870) | 18,416 |

| Total | (2,134) | (5,958) | (6,825) | 60,607 |

- The accounts have recognised a $2,134,000 cumulative share-based payment charge since 2010.

- However, the company actually paid $12,783,000 to settle the vested options for cash. That way, the share count would not be diluted by the options.

- Total earnings between 2010 and 2017 came to $60,607,000. The difference between the share-based payment charge and the cash settlement — $10,649,000 — represented 17.5% of total earnings and reflected the real-life cost of those options.

- Arguably total earnings during the period were overstated by 17.5%.

Maynard,

Regards SAF option scheme

The 2011 AR outlines a clause that the options could not be exercisable if it took the holding of a director above 29.99%, as both brothers had holdings in the high 20’s it seemed to rule out them being able to be exercised. When their father died his options lapsed rather than being exercised by the estate reinforcing this interpretation imo.

Hello Patrick

Thanks for the comment and the apologies for the tardy reply.

Oh dear — I did not look at the 2011 AR and I now see the clause in question. Very good spot by the way.

I will have to find another bad options example. I have to admit, this options project is more complicated than I had initially thought. Oh well.

Maynard