***ShareScope New Subscriber Special Offer***

Readers of my blog can enjoy a 20% first-year discount! Click here for details >>

16 August 2024

By Maynard Paton

Could now be the time to back Nick Train?

The buy-and-hold fund manager was for years feted for selecting blue-chip multi-baggers such as Diageo, RELX and London Stock Exchange.

But recent times have witnessed a stark change to market conditions…

…and Mr Train admitting to a “mortifying” underperformance that even necessitated a public apology.

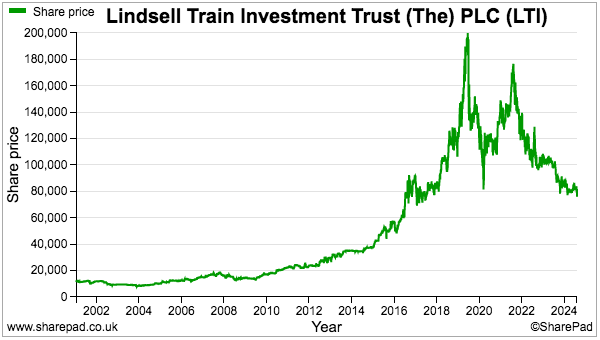

The shares of Lindsell Train Investment Trust, an investment trust managed by Mr Train, have for example lost 60% from their 2019 peak and are now back to a level first achieved eight years ago:

Yet Mr Train’s supporters may now want to consider this £154 million trust as a way of profiting from his potential comeback.

Importantly, this trust owns 24% of Mr Train’s fund-management firm, which last year paid a £39 million dividend split between Mr Train, his colleagues and this trust…

…and yet this 24% stake appears valued by the stock market at less than 2x earnings.

Let’s take a closer look.

Read my full LINDSELL TRAIN INVESTMENT TRUST article for SharePad >>Maynard Paton

Hi Maynard

Very good analysis but I got a little lost in your valuation of the fund management activites of Lindsell Train IT.. Your argument I think is that if you value the quoted shares as at market then the unquoted fund management activities are worth very little.

You could use the same argument on say Caledonia IT. If you valued the easily disposable quoted shares at market then the private unquoted investments were at a 67% discount to NAV. The problem is that they have been at a similar discount for a very long time. I suspect RIT’s unquoted shares are at a similar discount

Fund management companies seem to be very much out of favour. Liontrust currently has lots of cash and yields 13% with an almost covered dividend. Has been like this for at least a year as they constantly announce a reduction in assets under management even though their investment performance has been quite good

I hold both Liontrust and Lindsell Trust and thinks they are both hugely undervalued. Max

Hi Max

Thanks for the comment.

Yes, you are correct about the valuation theory. From the article:

“Fast forward to today, and the £770 share price supports a £154 million market cap for the trust and, with the other investments carried at a £136 million book value, implies the 24% stake in Lindsell Train Limited could be worth as little as £18 million…

…which in turn implies all of Lindsell Train Limited might be worth just £75 million and less than 2x the fund manager’s recent £45 million earnings”

The difference perhaps with LTI versus Caledonia and RIT is LTI’s unquoted investment has been valued at a premium in the past — which may provide hope that one day it can do so again. But as say, the wider fund-management sector is deeply out of favour and maybe LTI’s share price simply reflects that same investor scepticism. The industry does suffer from notable drawbacks, not least cheaper and often better-performing trackers that put persistent pressure on fee rates. Plus hefty staff costs that seem to increase regardless of whether the clients do well or not. If one day the Mag7 falter and global trackers flatline for some time, then maybe active stock-picking can enjoy an AUM rebound and entertain a sector re-rating.

Maynard