***ShareScope New Subscriber Special Offer***

Readers of my blog can enjoy a 20% first-year discount! Click here for details >>

12 August 2023

By Maynard Paton

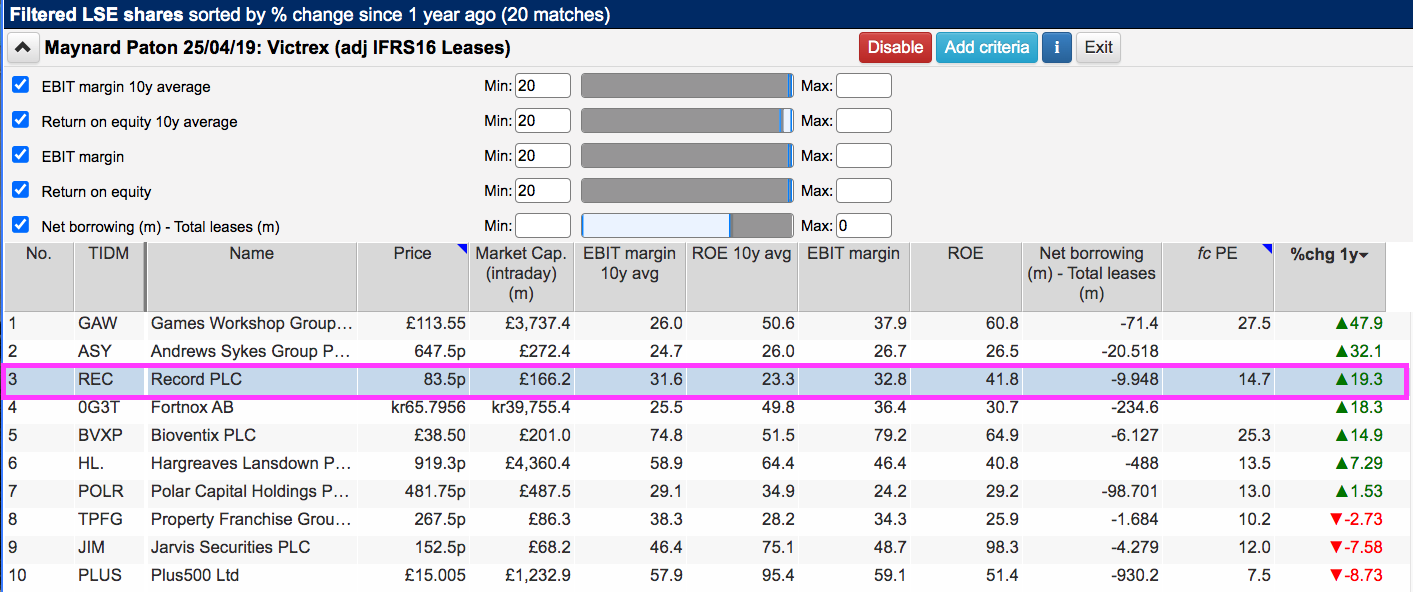

I have once again revisited a SharePad screen that applies two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE).

The exact criteria I re-used were:

- An operating margin (latest and 10-year average) of 20% or more, and;

- An ROE (latest and 10-year average) of 20% or more.

Any business with a persistent margin and ROE of at least 20% could be very special.

To narrow the field down further, I also sought companies that carried net cash (i.e. net borrowings excluding IFRS 16 finance leases of less than zero):

This time the filter yielded 20 matches, including Games Workshop, Hargreaves Lansdown, Plus 500 and Polar Capital.

I selected Record because it was among the better share-price performers of the last twelve months that I had not already studied for SharePad. Let’s take a closer look.

Read my full RECORD article for SharePad >>Maynard Paton