04 September 2015

By Maynard Paton

Today I’m continuing my hunt for Watch List shares with a look at Castings (CGS).

Here are the initial attractions that prompted this research:

Respectable financials: The accounts showcase a dependable dividend, net cash and property assets

Straightforward management: The executives do not collect grandiose wages nor own any options

Interesting valuation: The shares could offer a possible P/E of 11

As usual, I’m applying a question-and-answer template to help me pinpoint companies that match the criteria set out in How I Invest. I’m looking for as many Yes answers as possible.

Activity: Designer and manufacturer of iron castings

Website: www.castings.plc.uk

Share price: 420p

Shares in issue: 43,632,068

Market capitalisation: £183.3m

Does the business boast a respectable track record?

Yes.

CGS was established in 1907 and I have the impression it has been designing and manufacturing iron castings ever since. These days the group is known mostly for supplying the commercial-vehicle industry with products such as differentials, steering knuckles, brake shoes and turbo housings. The group also makes brackets, shoulders and assemblies for rail networks.

I don’t know when CGS floated, but Companies House has annual reports stretching back to 1995. The archives show that, during 1991, the group reported revenues of £24m, pre-tax profits of £4m and a dividend of 1.9p per share.

By 2015, revenues had reached £131m, pre-tax profits were £17m while the dividend had advanced to 13.3p per share.

The growth rate over time has generally been modest, with the expansion seen during the last five years mostly reflecting the group’s recovery from the financial crisis:

| 5 years to 2015 | 10 years to 2015 | 15 years to 2015 | 20 years to 2015 | |

| Revenue CAGR | 16.7% | 6.6% | 5.9% | 4.9% |

| Operating profit CAGR | 12.9% | 7.5% | 4.3% | 4.7% |

| Dividend per share CAGR | 5.9% | 4.2% | 4.2% | 7.1% |

CGS’s progress has not been entirely smooth. Revenue and underlying profits essentially stagnated between 1997 and 2005, while the banking crash caused profits to halve during 2009. The table below shows setbacks also occurring during 2013 and 2015:

| Year to 31 March | 2011 | 2012 | 2013 | 2014 | 2015 |

| Revenue (£k) | 101,368 | 126,271 | 122,215 | 137,466 | 131,268 |

| Operating profit (£k) | 14,991 | 22,244 | 18,702 | 21,286 | 17,386 |

| Other items (£k) | 352 | 693 | 149 | 363 | 24 |

| Finance income (£k) | 158 | 156 | 306 | 184 | 137 |

| Pre-tax profit (£k) | 15,501 | 23,093 | 19,157 | 21,833 | 17,547 |

| Earnings per share (p) | 26.7 | 40.3 | 33.9 | 39.6 | 31.8 |

| Dividend per share (p) | 10.8 | 11.8 | 12.3 | 13.0 | 13.3 |

Nonetheless, the dividend has made dependable advances. It was raised every year between 1992 and 2008, after which it was held for two years. The payout has since been lifted every year.

I’m encouraged how CGS’s results have not been blighted by recurring exceptional items. The largest one-off charges occurred during 2009, when the group lost £4m held in Icelandic banks and had to spend £2m on redundancy payments. Subsequent exceptional items have related to the money recovered from the failed Icelandic banks.

Has the business grown mostly without acquisition?

Yes.

As far as I can tell, the last acquisition was completed in 1996 and cost only £150k. The balance sheet carries no goodwill.

Has the business mostly self-funded its growth?

Yes.

The latest balance sheet displays share capital of £5m versus earnings retained by the business of £114m. Furthermore, no new shares have been issued since 2003.

Does the business possess an asset-strong balance sheet?

Yes.

CGS has operated with a net cash position since at least 1994. At the last count, cash was £30m while debt was zero. A bonus is land and buildings with a historical-cost book value of £26m.

A fascinating feature of CGS’s accounts is its defined-benefit pension scheme. Usually such pension schemes operate with a funding deficit, but the CGS scheme stands out for three reasons:

- It has reported a surplus every year since 2007;

- The surplus is significant in relation to profits — £14.6m versus operating profits of £17.4m, and;

- The scheme’s trustees have agreed to return £5m of the surplus back to CGS.

I have never before come across a quoted company where its final-salary pension scheme is so over-funded, the trustees have agreed to hand back some of the surplus!

The 2015 annual report states the money will be returned through instalments (presumably annual — the timescale is not mentioned) starting later this year.

I must admit, I am not entirely sure about any pension fund handing money back to its company sponsor. Pension liabilities are affected by all sorts of financial and demographic assumptions, and I would have thought the safest course of action for any pension trustee would be to hand back any surplus only when the last scheme member dies — just in case.

Does the business convert profits into free cash?

Sort of.

| Year to 31 March | 2011 | 2012 | 2013 | 2014 | 2015 |

| Operating profit (£k) | 14,991 | 22,244 | 18,702 | 21,286 | 17,386 |

| Depreciation (£k) | 5,606 | 6,188 | 7,416 | 6,046 | 6,760 |

| Net capital expenditure (£k) | (9,892) | (12,591) | (6,846) | (9,659) | (8,138) |

| Working-capital movement (£k) | (5,361) | (3,393) | (3,644) | (16) | (4,095) |

| Net cash (£k) | 13,707 | 17,805 | 23,654 | 27,780 | 30,021 |

True, the last five years have seen total cash capital expenditure exceed the aggregate depreciation charged against reported profits. But the excess has been spent largely on land and buildings, which tends to be expansionary expenditure and should hold its value.

On the working-capital front, changes in stock, debtor and creditor levels since 2011 have absorbed almost £17m — which is a sizeable amount when aggregate operating profits during the same time have come to £95m.

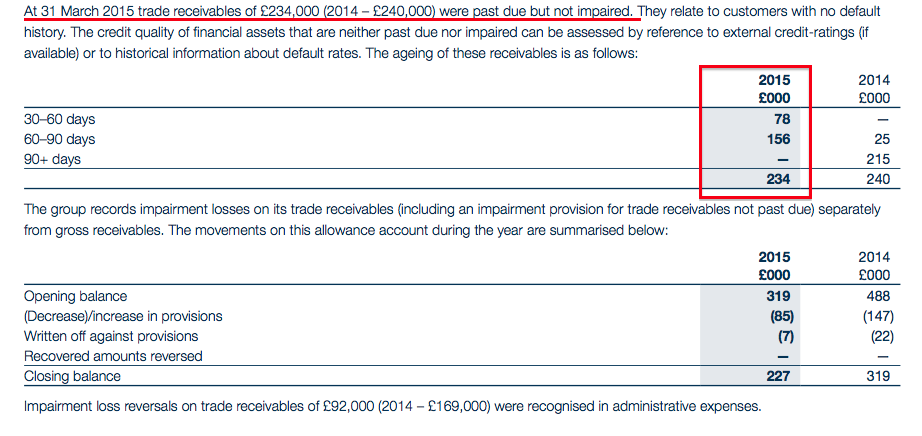

Mind you, my ratio calculations for stock turn and debtor days do not reveal any obvious alarming trends, while I note in particular CGS has minimal trade invoices that have become ‘past due’:

All told, I think I just have to accept CGS does not have the best of cash conversions — with money spent upfront during production and received later from clients when the casting is delivered.

Does the business enjoy a competitive advantage?

Possibly.

Within the last five years, operating margins have bounced between 13% and 18% and averaged 15.2%. For the last ten years, the average has been 14.6%.

Such levels of profitability are quite respectable, given CGS supplies major vehicle manufacturers — which are not known for being too generous with their suppliers. I suspect CGS’s pricing power could be aided somewhat by the group’s long-standing reputation and some tip-top casting facilities.

CGS states its aim is to build “long-term supply relationships” with its clients, which is just as well — because for the last four years, about 46% of annual revenues have come from just three customers.

The 2015 annual report also states: “We seek to enhance our strong margins by continually striving for further operational efficiencies. These efficiencies also provide the opportunity to invest in growth.”

Confirming the efficient progress, I note revenue per staff member has advanced a substantial 62% to £117k during the last decade. That scale of improvement must be due to greater automation of the production line.

Does the business produce a respectable return on equity?

Yes.

Return on average equity for 2015 was £13.9m/£115.1m = 12%. However, stripping out the group’s cash from the equity base gives a 16% figure. Not bad — although it is below the 19%-plus seen between 2011 and 2014. The ten-year ROE average adjusted for the cash position is about 17%.

Does the business employ capable executives?

Possibly.

The aforementioned track record of CGS was delivered by Brian Cooke, who first took on the lead executive job during 1970.

Sadly Mr Cooke retired from his role of executive chairman and became a non-exec earlier this year, so existing shareholders will have to trust the current chief exec from here on in.

At least the omens for a trouble-free handover are positive. Current boss David Gawthorpe joined the firm in 1984, became a director in 2003, was appointed as chief exec in 2007 and has a technical product background. So he certainly brings plenty of relevant work experience.

Mr Gawthorpe is in his 50s, so another retirement handover is not an obvious requirement at present.

Does the business employ good-value-for-money executives?

Yes.

Mr Gawthorpe received a £244k basic salary and an £82k bonus during 2015 — which do not look grandiose for a business making operating profits of £17m-plus.

I should add that CGS’s directors receive annual bonuses based on how far operating profits top £10m. I like this bonus simplicity, but it does mean the board could collect extra cash during times when the business stagnates.

Does the business employ owner-orientated executives?

I’m not sure.

Mr Cooke continues to hold a 4%/£8m stake, which has been largely unchanged since at least 1994 and clearly gave him the owner’s eye.

However, the other four executives that now run the business hold a combined shareholding currently worth about £200k. So things have become somewhat less clear cut.

Anyway, I do like the fact the executives can work without needing an option scheme.

Does the business enjoy reasonable growth prospects?

I think so.

The outlook given within the 2015 chairman’s review stated:

“In general we are now experiencing improved volumes from many of our customers and it is anticipated profits will increase providing the recovery continues.”

The 2015 annual report supplied further optimism:

“With customer requirements forecast to increase from current levels, particularly in the commercial vehicles sector, it is hoped that the foundry operations can improve performance during the current financial year. Following investment in processing, finishing and warehousing during the year, it is not anticipated that significant further investment in the foundry operations will be required to satisfy the current or anticipated levels of demand.”

“We have invested £3.9 million during the year to accommodate new orders and will continue to do so as and when the order book grows further. In the current year, the [machining] business expects to benefit from the commercial vehicle market increases in line with the foundry operations and for volumes from other markets to remain strong.”

An AGM statement last month then claimed:

“Following the statement in the Chairman`s report in June, it is pleasing to report sales volumes are still improving in particular in the commercial vehicle sector. We see no change in the foreseeable future and provided there is no adverse economic and world news it is expected profits will improve on last year’s level.”

Long term, progress will depend mostly on the health of the European vehicle industry. One-third of sales are from the UK while almost two-thirds are to customers from the continent.

Does the share price stand a good chance of becoming a bargain?

The shares do not appear expensive at present.

Taking 2015 operating profits of £17.4m and applying tax at the standard UK rate of 20%, I arrive at possible earnings of £13.9m or 31.9p per share.

Then subtracting the £30m, or 70p per share, net cash position from the £183m market cap, I come to an enterprise value (EV) of £153m or roughly 350p per share.

The potential P/E on the my EV and EPS estimates is therefore 350p/31.9 = 11. The trailing 13.3p per share dividend supports a 3.2% income.

Is it worth watching Castings?

I think so.

There’s a lot to like about CGS — not least the dependable dividend history, the regular net cash position, the respectable returns on equity and the somewhat dull nature of the business.

Certainly I have a better feeling about CGS than Dewhurst and Zytronic — two shares I rejected earlier this year. I also have a better feeling about CGS than some of the ‘value’ plays I currently own.

A 420p share price does not look that expensive either.

That said, CGS does have its downsides — not least veteran boss Brian Cooke stepping down to leave investors with an executive team that possesses only a token shareholding.

Plus there is that substantial dependence on a trio of (presumably) powerful customers, as well as the profit history that includes a long period of treading water.

Anyway, with distinguished track records and reasonable valuations quite a rare combination in the current market, I think CGS is worthy of further consideration — and goes on to my watch list.

Maynard Paton

Disclosure: Maynard does not own shares in Castings.